E-Invoicing in Germany from 2025 – What Businesses Need to Know February 19, 2026 This VIDA Country Report provides a structured overview of Germany’s e invoicing framework, including the introduction of mandatory B2B e invoicing, the use of structured formats, and the transition toward a standardized national system aligned with European requirements. Read More

E-Invoicing in Germany from 2025 – What Businesses Need to Know February 19, 2026 This VIDA Country Report provides a structured overview of Germany’s e invoicing framework, including the introduction of mandatory B2B e invoicing, the use of structured formats, and the transition toward a standardized national system aligned with European requirements. Read More E-invoicing in Greece in 2026 – The digital era is already here – but are we ready? February 19, 2026 This VIDA Country Report provides a structured overview of Greece’s e invoicing and e recordkeeping framework, including the myDATA platform, voluntary B2B e invoicing, certified service providers, and the gradual expansion of digital reporting obligations. Read More

E-invoicing in Greece in 2026 – The digital era is already here – but are we ready? February 19, 2026 This VIDA Country Report provides a structured overview of Greece’s e invoicing and e recordkeeping framework, including the myDATA platform, voluntary B2B e invoicing, certified service providers, and the gradual expansion of digital reporting obligations. Read More E-invoicing in France in 2026 February 19, 2026 This VIDA Country Report provides a structured overview of France’s e invoicing and digital reporting framework, including the phased implementation of mandatory B2B e invoicing, the role of the national Chorus Pro platform, and the transition toward a decentralized exchange model. Read More

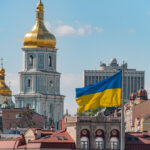

E-invoicing in France in 2026 February 19, 2026 This VIDA Country Report provides a structured overview of France’s e invoicing and digital reporting framework, including the phased implementation of mandatory B2B e invoicing, the role of the national Chorus Pro platform, and the transition toward a decentralized exchange model. Read More E-invoicing in Ukraine in 2026 February 19, 2026 A detailed overview of Ukraine’s e invoicing environment, including VAT electronic administration, EDI usage, reporting standards, Peppol pilot projects, and expected developments in digital tax compliance. Read More

E-invoicing in Ukraine in 2026 February 19, 2026 A detailed overview of Ukraine’s e invoicing environment, including VAT electronic administration, EDI usage, reporting standards, Peppol pilot projects, and expected developments in digital tax compliance. Read More E-invoicing Current UK Position February 19, 2026 An overview of the UK’s current e invoicing landscape, including voluntary adoption trends, HMRC’s consultation on future policy, ICAEW recommendations, and the status of government findings on potential e invoicing and real time reporting reforms. Read More

E-invoicing Current UK Position February 19, 2026 An overview of the UK’s current e invoicing landscape, including voluntary adoption trends, HMRC’s consultation on future policy, ICAEW recommendations, and the status of government findings on potential e invoicing and real time reporting reforms. Read More E-invoicing in Poland in 2026 February 19, 2026 A clear, up to date overview of Poland’s mandatory e invoicing system (KSeF), including implementation timelines, exemptions, structured invoice rules, authorization procedures (ZAW FA), and penalties effective through 2027. Read More

E-invoicing in Poland in 2026 February 19, 2026 A clear, up to date overview of Poland’s mandatory e invoicing system (KSeF), including implementation timelines, exemptions, structured invoice rules, authorization procedures (ZAW FA), and penalties effective through 2027. Read More E-invoicing in Netherlands in 2026 February 19, 2026 Dutch e invoicing rules, Peppol standards, and ViDA compliance requirements explained, with key dates and implementation steps through 2030 Read More

E-invoicing in Netherlands in 2026 February 19, 2026 Dutch e invoicing rules, Peppol standards, and ViDA compliance requirements explained, with key dates and implementation steps through 2030 Read More E-invoicing in Malta in 2026 February 19, 2026 This VIDA Country Report provides a structured overview of Malta’s e invoicing framework, including mandatory B2G e invoicing, structured format requirements, and the national Peppol based infrastructure supporting public sector procurement. Read More

E-invoicing in Malta in 2026 February 19, 2026 This VIDA Country Report provides a structured overview of Malta’s e invoicing framework, including mandatory B2G e invoicing, structured format requirements, and the national Peppol based infrastructure supporting public sector procurement. Read More E-invoicing in Luxembourg in 2026 February 19, 2026 This VIDA Country Report provides a structured overview of Luxembourg’s e invoicing framework, including mandatory B2G e invoicing, structured format requirements, and the national Peppol based exchange infrastructure. Read More

E-invoicing in Luxembourg in 2026 February 19, 2026 This VIDA Country Report provides a structured overview of Luxembourg’s e invoicing framework, including mandatory B2G e invoicing, structured format requirements, and the national Peppol based exchange infrastructure. Read More E-invoicing Overview and current developments: ITALY 2026 February 19, 2026 This ViDA Country Report provides a clear overview of Italy’s e-invoicing and digital reporting system, describing the gradual introduction of mandatory B2B e-invoicing, the functioning of the national SdI exchange platform, and the evolution toward a structured real-time reporting model. Read More

E-invoicing Overview and current developments: ITALY 2026 February 19, 2026 This ViDA Country Report provides a clear overview of Italy’s e-invoicing and digital reporting system, describing the gradual introduction of mandatory B2B e-invoicing, the functioning of the national SdI exchange platform, and the evolution toward a structured real-time reporting model. Read More Why e-Invoicing? The EU Commission Perspective February 19, 2026 VIDA (VAT in the Digital Age) is the European Union’s major reform initiative to modernize VAT systems for a digital economy. It introduces harmonized e‑invoicing, real‑time reporting, and simplified cross‑border compliance across all Member States. VIDA is built on three core pillars: Digital Reporting & Mandatory E‑Invoicing Structured e‑invoicing (EN 16931) becomes the default for intra‑EU B2B transactions, supported by near‑real‑time reporting to tax authorities. Platform Economy Rules New deemed‑supplier provisions clarify VAT responsibilities for digital platforms facilitating accommodation, transport, and goods. Single VAT Registration (SVR) Expanded OSS/IOSS systems reduce the need for multiple VAT registrations and streamline cross‑border VAT… Read More

Why e-Invoicing? The EU Commission Perspective February 19, 2026 VIDA (VAT in the Digital Age) is the European Union’s major reform initiative to modernize VAT systems for a digital economy. It introduces harmonized e‑invoicing, real‑time reporting, and simplified cross‑border compliance across all Member States. VIDA is built on three core pillars: Digital Reporting & Mandatory E‑Invoicing Structured e‑invoicing (EN 16931) becomes the default for intra‑EU B2B transactions, supported by near‑real‑time reporting to tax authorities. Platform Economy Rules New deemed‑supplier provisions clarify VAT responsibilities for digital platforms facilitating accommodation, transport, and goods. Single VAT Registration (SVR) Expanded OSS/IOSS systems reduce the need for multiple VAT registrations and streamline cross‑border VAT… Read More E-invoicing in Japan in 2026 February 19, 2026 This VIDA Country Report provides a structured overview of Japan’s Qualified Invoice System, including registration requirements, invoice content rules, and the transition to a standardized consumption tax invoicing framework. Read More

E-invoicing in Japan in 2026 February 19, 2026 This VIDA Country Report provides a structured overview of Japan’s Qualified Invoice System, including registration requirements, invoice content rules, and the transition to a standardized consumption tax invoicing framework. Read More E-invoicing in USA in 2026 February 19, 2026 A concise 2026 overview of U.S. e invoicing developments, including the absence of federal and state mandates, the role of the Business Payments Coalition, and the creation of the DBNAlliance exchange framework modernizing B2B invoicing and payment processes. Read More

E-invoicing in USA in 2026 February 19, 2026 A concise 2026 overview of U.S. e invoicing developments, including the absence of federal and state mandates, the role of the Business Payments Coalition, and the creation of the DBNAlliance exchange framework modernizing B2B invoicing and payment processes. Read More Transfer Pricing Essentials: Navigating Risks and Compliance for Your Multinational Business November 17, 2025 Author: Victor Serrão, CPA Pitmen Auditores Independentes / Tax Partner E: [email protected] Edited by: Integra International Grant Gilmour, B.Sc., MBA, CA, CPA Canada, BC, CPA USA, Az, GDipICL.Sc. INTEGRA TAX WORLD NEWSLETTER EDITOR E: [email protected] Transfer Pricing Essentials: Navigating Risks and Compliance for Your Multinational Business The Critical Importance of Transfer Pricing in Today's Global Economy: Beyond Compliance to Strategic Advantage For any company operating across international borders, managing transfer pricing has transcended its role as a mere niche financial task. It stands as a fundamental pillar of international tax compliance and, more importantly, a powerful lever for strategic business… Read More

Transfer Pricing Essentials: Navigating Risks and Compliance for Your Multinational Business November 17, 2025 Author: Victor Serrão, CPA Pitmen Auditores Independentes / Tax Partner E: [email protected] Edited by: Integra International Grant Gilmour, B.Sc., MBA, CA, CPA Canada, BC, CPA USA, Az, GDipICL.Sc. INTEGRA TAX WORLD NEWSLETTER EDITOR E: [email protected] Transfer Pricing Essentials: Navigating Risks and Compliance for Your Multinational Business The Critical Importance of Transfer Pricing in Today's Global Economy: Beyond Compliance to Strategic Advantage For any company operating across international borders, managing transfer pricing has transcended its role as a mere niche financial task. It stands as a fundamental pillar of international tax compliance and, more importantly, a powerful lever for strategic business… Read More Poland introduces a new mandatory e-invoicing system in 2026 November 15, 2025 Author: Marcin Kaczanowicz Doradca Podatkowy / Tax Advisor INDEPENDENT TAX ADVISERS Doradztwo Podatkowe Sp. z o.o. E: [email protected] Edited by: Integra International Grant Gilmour, B.Sc., MBA, CA, CPA Canada, BC, CPA USA, Az, GDipICL.Sc. INTEGRA TAX WORLD NEWSLETTER EDITOR E: [email protected] Poland introduces a new mandatory e-invoicing system in 2026 Poland is going to introduce a new, mandatory e-invoicing system (called: KSeF). Application will be obligatory for most VAT taxpayers in 2026. The purpose of KSeF is digitalization of invoicing and improvement of accounting processes. Thanks to KSeF, the tax authorities will be able to fight VAT frauds more effectively… Read More

Poland introduces a new mandatory e-invoicing system in 2026 November 15, 2025 Author: Marcin Kaczanowicz Doradca Podatkowy / Tax Advisor INDEPENDENT TAX ADVISERS Doradztwo Podatkowe Sp. z o.o. E: [email protected] Edited by: Integra International Grant Gilmour, B.Sc., MBA, CA, CPA Canada, BC, CPA USA, Az, GDipICL.Sc. INTEGRA TAX WORLD NEWSLETTER EDITOR E: [email protected] Poland introduces a new mandatory e-invoicing system in 2026 Poland is going to introduce a new, mandatory e-invoicing system (called: KSeF). Application will be obligatory for most VAT taxpayers in 2026. The purpose of KSeF is digitalization of invoicing and improvement of accounting processes. Thanks to KSeF, the tax authorities will be able to fight VAT frauds more effectively… Read More Vietnam Enters the Global Minimum Tax Era Decree 236-2025-ND-CP November 15, 2025 Author: Dr. Phan Hoai Nam W&A Consulting, Legal - Tax - Finance / CEO & Managing Partner E: [email protected] Edited by: Integra International Grant Gilmour, B.Sc., MBA, CA, CPA Canada, BC, CPA USA, Az, GDipICL.Sc. INTEGRA TAX WORLD NEWSLETTER EDITOR E: [email protected] Vietnam Enters the Global Minimum Tax Era Decree 236-2025-ND-CP Context and significance On 29 August 2025, the Government of Vietnam issued Decree 236/2025/ND-CP to implement Resolution 107/2023/QH15 on the Global Minimum Tax (GMT) regime. This is not merely a technical regulation but a strategic step aligning Vietnam with over 140 jurisdictions in the global effort to counter base… Read More

Vietnam Enters the Global Minimum Tax Era Decree 236-2025-ND-CP November 15, 2025 Author: Dr. Phan Hoai Nam W&A Consulting, Legal - Tax - Finance / CEO & Managing Partner E: [email protected] Edited by: Integra International Grant Gilmour, B.Sc., MBA, CA, CPA Canada, BC, CPA USA, Az, GDipICL.Sc. INTEGRA TAX WORLD NEWSLETTER EDITOR E: [email protected] Vietnam Enters the Global Minimum Tax Era Decree 236-2025-ND-CP Context and significance On 29 August 2025, the Government of Vietnam issued Decree 236/2025/ND-CP to implement Resolution 107/2023/QH15 on the Global Minimum Tax (GMT) regime. This is not merely a technical regulation but a strategic step aligning Vietnam with over 140 jurisdictions in the global effort to counter base… Read More Navigating the Impact of Nigeria’s Tax Reform Acts 2025 on Foreign Investors August 14, 2025 Authors: Tunde Adaramaja Managing Consultant/CEO E: [email protected] James Oni Director, Taxation & Regulatory Advisory E: [email protected] Edited by: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Navigating the Impact of Nigeria's Tax Reform Acts 2025 on Foreign Investors Introduction The enactment of the Nigeria Tax Reform Acts 2025 (“NTA” or “The Acts”) represents a landmark shift in the country’s fiscal and regulatory landscape. It is designed to modernize the tax system, improve revenue generation, and enhance alignment with international tax principles, these reforms introduce far-reaching provisions that directly affect foreign investors,… Read More

Navigating the Impact of Nigeria’s Tax Reform Acts 2025 on Foreign Investors August 14, 2025 Authors: Tunde Adaramaja Managing Consultant/CEO E: [email protected] James Oni Director, Taxation & Regulatory Advisory E: [email protected] Edited by: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Navigating the Impact of Nigeria's Tax Reform Acts 2025 on Foreign Investors Introduction The enactment of the Nigeria Tax Reform Acts 2025 (“NTA” or “The Acts”) represents a landmark shift in the country’s fiscal and regulatory landscape. It is designed to modernize the tax system, improve revenue generation, and enhance alignment with international tax principles, these reforms introduce far-reaching provisions that directly affect foreign investors,… Read More Planning for the New U.S. Tariffs in the U.S. and Worldwide August 14, 2025 Author: Christopher Klug BA, JD, LLM Basswood Counsel PLLC (formerly Klug Counsel PLLC) E: [email protected] Edited by: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Planning for the New U.S. Tariffs in the U.S. and Worldwide A significant part of President Trump’s policy is to use tariffs to increase production in the United States. The tariffs are certainly controversial with United States trading partners and most country specific tariff rates are still being negotiated. Recently, the United States and Japan agreed to a tariff rate of 15% and the United States… Read More

Planning for the New U.S. Tariffs in the U.S. and Worldwide August 14, 2025 Author: Christopher Klug BA, JD, LLM Basswood Counsel PLLC (formerly Klug Counsel PLLC) E: [email protected] Edited by: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Planning for the New U.S. Tariffs in the U.S. and Worldwide A significant part of President Trump’s policy is to use tariffs to increase production in the United States. The tariffs are certainly controversial with United States trading partners and most country specific tariff rates are still being negotiated. Recently, the United States and Japan agreed to a tariff rate of 15% and the United States… Read More Reform of the UK Non-Dom tax regime. What has changed? May 29, 2025 Author: Eugenia Campbell Partner bright grahame murray, Chartered Accountants E: [email protected] Edited by: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Reform of the UK Non-Dom tax regime. What has changed? From 6 April 2025 the UK non-dom regime was abolished and replaced by a 4-year foreign income and gains (FIG) regime, which is tax residence based. The concept of long-term tax resident (“LTR”) was introduced, and domicile was removed for tax purposes, although it remains relevant for pre-April 2025 tax considerations. Taxpayers who do not qualify for the FIG regime… Read More

Reform of the UK Non-Dom tax regime. What has changed? May 29, 2025 Author: Eugenia Campbell Partner bright grahame murray, Chartered Accountants E: [email protected] Edited by: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Reform of the UK Non-Dom tax regime. What has changed? From 6 April 2025 the UK non-dom regime was abolished and replaced by a 4-year foreign income and gains (FIG) regime, which is tax residence based. The concept of long-term tax resident (“LTR”) was introduced, and domicile was removed for tax purposes, although it remains relevant for pre-April 2025 tax considerations. Taxpayers who do not qualify for the FIG regime… Read More Unlock Exceptional Tax Advantages and an Enviable Lifestyle by Moving to Gibraltar May 29, 2025 Author: Paul Correa Managing Director Fiduciary Wealth Management Limited E: [email protected] Edited by: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Unlock Exceptional Tax Advantages and an Enviable Lifestyle by Moving to Gibraltar Moving to Gibraltar is becoming increasingly attractive for foreign nationals seeking significant tax advantages and an enhanced quality of life. Commonly referred to as "The Rock of Gibraltar," this British Overseas Territory provides considerable tax benefits, making it particularly appealing to expats pursuing Gibraltar Residency. This article explores why Gibraltar should be considered a leading destination for… Read More

Unlock Exceptional Tax Advantages and an Enviable Lifestyle by Moving to Gibraltar May 29, 2025 Author: Paul Correa Managing Director Fiduciary Wealth Management Limited E: [email protected] Edited by: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Unlock Exceptional Tax Advantages and an Enviable Lifestyle by Moving to Gibraltar Moving to Gibraltar is becoming increasingly attractive for foreign nationals seeking significant tax advantages and an enhanced quality of life. Commonly referred to as "The Rock of Gibraltar," this British Overseas Territory provides considerable tax benefits, making it particularly appealing to expats pursuing Gibraltar Residency. This article explores why Gibraltar should be considered a leading destination for… Read More Tariffs? What are they and how do they work? A glossary for accountants and their clients. May 29, 2025 Author: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Tariffs? What are they and how do they work? A glossary for accountants and their clients. Tariffs are defined by the World Trade Organization as customs duties on imports. The roll of accountants and tax and legal advisors is to help clients understand and either mitigate the impact of taxes or recognize opportunities in taxation for savings. Tariffs and duties are a form of taxation. But until recently they were stable and predictable and often were not considered as planning opportunities… Read More

Tariffs? What are they and how do they work? A glossary for accountants and their clients. May 29, 2025 Author: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Tariffs? What are they and how do they work? A glossary for accountants and their clients. Tariffs are defined by the World Trade Organization as customs duties on imports. The roll of accountants and tax and legal advisors is to help clients understand and either mitigate the impact of taxes or recognize opportunities in taxation for savings. Tariffs and duties are a form of taxation. But until recently they were stable and predictable and often were not considered as planning opportunities… Read More Understanding Japan’s Anti-Avoidance Rules and Tax Regulations February 19, 2025 Author: Manami Yahata Senior Tax Associate Actus Tax Corporation E: [email protected] with contributions from: Tetsunori (Ted) Chiba, LLM, MST International Tax Partner Actus Tax Corporation E: [email protected] Edited by: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Understanding Japan's Anti-Avoidance Rules and Tax Regulations Japan has developed a robust system to prevent tax avoidance, particularly through the use of foreign subsidiaries or corporate structures that minimize tax liabilities. While Japan does not have a General Anti-Avoidance Rule (GAAR) like some other countries, it addresses tax avoidance using targeted, specific anti-avoidance… Read More

Understanding Japan’s Anti-Avoidance Rules and Tax Regulations February 19, 2025 Author: Manami Yahata Senior Tax Associate Actus Tax Corporation E: [email protected] with contributions from: Tetsunori (Ted) Chiba, LLM, MST International Tax Partner Actus Tax Corporation E: [email protected] Edited by: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Understanding Japan's Anti-Avoidance Rules and Tax Regulations Japan has developed a robust system to prevent tax avoidance, particularly through the use of foreign subsidiaries or corporate structures that minimize tax liabilities. While Japan does not have a General Anti-Avoidance Rule (GAAR) like some other countries, it addresses tax avoidance using targeted, specific anti-avoidance… Read More Lower Tax Using Alternative Taxation for New Residents in Greece February 5, 2025 Author: George Giannopoulos Partner E: [email protected] Edited by: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Lower Tax Using Alternative Taxation for New Residents in Greece In recent years, Greece has seen a growing international community, which includes retirees, professionals, students, and digital nomads. Foreign nationals living in Greece represent an expanding group of people who choose the country for various reasons. Climate: Mediterranean weather with mild winters and warm summers, ideal for outdoor activities. Relatively Low Cost of Living: Although living costs have risen recently, life in Greece is… Read More

Lower Tax Using Alternative Taxation for New Residents in Greece February 5, 2025 Author: George Giannopoulos Partner E: [email protected] Edited by: Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] Lower Tax Using Alternative Taxation for New Residents in Greece In recent years, Greece has seen a growing international community, which includes retirees, professionals, students, and digital nomads. Foreign nationals living in Greece represent an expanding group of people who choose the country for various reasons. Climate: Mediterranean weather with mild winters and warm summers, ideal for outdoor activities. Relatively Low Cost of Living: Although living costs have risen recently, life in Greece is… Read More Brazilian tax reforms: a lost opportunity? November 12, 2024 Author: Victor Serrão, CPA Partner, Pitmen Auditores Independentes W: www.pitmen.com.br E: [email protected] Edited by: Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] The Brazilian tax reform, a crucial initiative to simplify and modernize the country's tax system, is currently being processed by the National Congress. At the moment, the Chamber of Deputies is still negotiating internally the deadline to conclude the vote on the second text that complements the tax reform. Initially, the new legislation is expected to come into force in stages, between 2025 and 2033. The reform proposes the transition… Read More

Brazilian tax reforms: a lost opportunity? November 12, 2024 Author: Victor Serrão, CPA Partner, Pitmen Auditores Independentes W: www.pitmen.com.br E: [email protected] Edited by: Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] The Brazilian tax reform, a crucial initiative to simplify and modernize the country's tax system, is currently being processed by the National Congress. At the moment, the Chamber of Deputies is still negotiating internally the deadline to conclude the vote on the second text that complements the tax reform. Initially, the new legislation is expected to come into force in stages, between 2025 and 2033. The reform proposes the transition… Read More Taxable Income. What is that? November 12, 2024 Author: Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] With Contributions from: Franz Schweiger, BF Consulting Austria Dr. Filip Schade, Wagemann + Partner, Germany David Lucas, Bright Grahame Murray, United Kingdom Victor Serrao, Pitmen, Brazil Wayne Soo, Fiducia LLP, Singapore Edited by: Mark Saunders, BA FCA Chief Operating Officer Integra International E: [email protected] This is a question that tax practitioners around the world are often asked. Business owners and investors and really everyone would like the calculation of tax to be as simple as INCOME multiplied by 10 PERCENT gives TAX. And income… Read More

Taxable Income. What is that? November 12, 2024 Author: Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Integra Tax World Newsletter Editor E: [email protected] With Contributions from: Franz Schweiger, BF Consulting Austria Dr. Filip Schade, Wagemann + Partner, Germany David Lucas, Bright Grahame Murray, United Kingdom Victor Serrao, Pitmen, Brazil Wayne Soo, Fiducia LLP, Singapore Edited by: Mark Saunders, BA FCA Chief Operating Officer Integra International E: [email protected] This is a question that tax practitioners around the world are often asked. Business owners and investors and really everyone would like the calculation of tax to be as simple as INCOME multiplied by 10 PERCENT gives TAX. And income… Read More Home Office Does Not Constitute Permanent Establishment for An Employer in Poland August 20, 2024 Author: Ewa Suwińska - Licensed Tax Advisor INDEPENDENT TAX ADVISERS Warsaw, Poland E: [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] Polish Judgement of the Voivodship Administrative Court Dated 11 June 2024 The Polish Voivodship Administrative Court (in Gliwice), in its judgment of 11 June 2024, (ref. no. I SA/Gl 914/23), addressed the issue of creation of a permanent establishment [PE] when employing staff in a home office. The case concerned whether a German company (Company) had or did not have its Poland registered office and management at the home… Read More

Home Office Does Not Constitute Permanent Establishment for An Employer in Poland August 20, 2024 Author: Ewa Suwińska - Licensed Tax Advisor INDEPENDENT TAX ADVISERS Warsaw, Poland E: [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] Polish Judgement of the Voivodship Administrative Court Dated 11 June 2024 The Polish Voivodship Administrative Court (in Gliwice), in its judgment of 11 June 2024, (ref. no. I SA/Gl 914/23), addressed the issue of creation of a permanent establishment [PE] when employing staff in a home office. The case concerned whether a German company (Company) had or did not have its Poland registered office and management at the home… Read More VAT treatment – Cross Border Transactions inside the European Union August 20, 2024 Author: Rakesh Ghirah LLM, Associate Partner VAT | Indirect Tax| Londen & Van Holland Amsterdam, Netherlands [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] Based on the Value Added Tax [VAT] Directive the VAT Law in the European Union is harmonized. In principle a 0% VAT rate applies to Business to Business [B2B] transactions where goods are supplied from one Member State to another. However, this 0% VAT rate can be exploited for carousel fraud, contributing significantly to the VAT Gap in Europe, which was estimated to be around €61… Read More

VAT treatment – Cross Border Transactions inside the European Union August 20, 2024 Author: Rakesh Ghirah LLM, Associate Partner VAT | Indirect Tax| Londen & Van Holland Amsterdam, Netherlands [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] Based on the Value Added Tax [VAT] Directive the VAT Law in the European Union is harmonized. In principle a 0% VAT rate applies to Business to Business [B2B] transactions where goods are supplied from one Member State to another. However, this 0% VAT rate can be exploited for carousel fraud, contributing significantly to the VAT Gap in Europe, which was estimated to be around €61… Read More Be Careful When the Terms of An Acquisition Seem Too Good to be True. They Usually Are August 20, 2024 Author: Christopher Klug BA, JD, LLM Basswood Counsel PLLC (formerly Klug Counsel PLLC) [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] When there is a cross-border merger and acquisition there are additional complexities to plan for, typical acquisition planning in one country may be different than in another country, and the resulting tax implications can be significant. Basswood have represented both the acquiror and target in a number of cross-border acquisitions and getting the right result requires a careful analysis of the tax implications involved. What may seem like a… Read More

Be Careful When the Terms of An Acquisition Seem Too Good to be True. They Usually Are August 20, 2024 Author: Christopher Klug BA, JD, LLM Basswood Counsel PLLC (formerly Klug Counsel PLLC) [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] When there is a cross-border merger and acquisition there are additional complexities to plan for, typical acquisition planning in one country may be different than in another country, and the resulting tax implications can be significant. Basswood have represented both the acquiror and target in a number of cross-border acquisitions and getting the right result requires a careful analysis of the tax implications involved. What may seem like a… Read More Attraction and Benefits of the UAE’s Corporate Tax Regime for International Businesses May 15, 2024 Author: Gopu Rama Naidu FCA, FCCA, CPA under and Managing Partner KGRN Chartered Accountants LLC [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] Embracing the Corporate Tax Landscape in the UAE: Opportunities for Global Business Growth The United Arab Emirates has recently ushered in a new era of fiscal policy with the implementation of Corporate Tax, effective from the tax periods commencing on or after June 1, 2023. This move is aimed at bolstering the nation’s economic diversification and aligning its tax practices with global standards. For international businesses considering… Read More

Attraction and Benefits of the UAE’s Corporate Tax Regime for International Businesses May 15, 2024 Author: Gopu Rama Naidu FCA, FCCA, CPA under and Managing Partner KGRN Chartered Accountants LLC [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] Embracing the Corporate Tax Landscape in the UAE: Opportunities for Global Business Growth The United Arab Emirates has recently ushered in a new era of fiscal policy with the implementation of Corporate Tax, effective from the tax periods commencing on or after June 1, 2023. This move is aimed at bolstering the nation’s economic diversification and aligning its tax practices with global standards. For international businesses considering… Read More New tax provisions in 2024 for Greece May 15, 2024 Author: George Giannopoulos Partner [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] Law 5104/2024 (Tax Procedure Code) was published on April 20th 2024 being effective immediately. The new Law indicates change in accounting – tax procedures and bring new procedures as well. Efficiency measures The main efficiency provisions of the Law 5104/2024 to update the Greece tax system include the following: Pre-filled tax returns: obligation to prepare tax returns is abolished for taxpayers, who have income exclusively from wages and pensions. The tax return is automatically pre-filled by the… Read More

New tax provisions in 2024 for Greece May 15, 2024 Author: George Giannopoulos Partner [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] Law 5104/2024 (Tax Procedure Code) was published on April 20th 2024 being effective immediately. The new Law indicates change in accounting – tax procedures and bring new procedures as well. Efficiency measures The main efficiency provisions of the Law 5104/2024 to update the Greece tax system include the following: Pre-filled tax returns: obligation to prepare tax returns is abolished for taxpayers, who have income exclusively from wages and pensions. The tax return is automatically pre-filled by the… Read More Tax Obligations for Related Parties – Transfer Pricing in Latin America May 15, 2024 Originally Published in Spanish, Please look at the bottom of the article for the Spanish Version. Publicado originalmente en español, consulte la parte inferior del artículo para ver la versión en español. Author: Lic. Salvador Pizano Moreno Gerente/ Manager [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] Transfer pricing, an important and controllable aspect of international taxation, refers to the prices at which companies within an international corporate group transfer goods, services, or intangible assets between each other. The forward at paragraph 11 of the OECD Transfer Pricing Guides. Says… Read More

Tax Obligations for Related Parties – Transfer Pricing in Latin America May 15, 2024 Originally Published in Spanish, Please look at the bottom of the article for the Spanish Version. Publicado originalmente en español, consulte la parte inferior del artículo para ver la versión en español. Author: Lic. Salvador Pizano Moreno Gerente/ Manager [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] Transfer pricing, an important and controllable aspect of international taxation, refers to the prices at which companies within an international corporate group transfer goods, services, or intangible assets between each other. The forward at paragraph 11 of the OECD Transfer Pricing Guides. Says… Read More What is going on in “Good old Germany” in taxes? a Commentary February 22, 2024 Author: By Dr. Filip Schade, Steuerberater, Master of Laws Wagemann + Partner PartG mbB, Berlin, E: [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] In this article, I will give you a brief overview of the current economic situation in Germany and the reasons for this development. Following this, I will explain existing and planned tax incentives and subsidies and critically assess them. At the end of the article I will make four proposals for a more far-reaching reform of German tax law in order to make Germany attractive again as… Read More

What is going on in “Good old Germany” in taxes? a Commentary February 22, 2024 Author: By Dr. Filip Schade, Steuerberater, Master of Laws Wagemann + Partner PartG mbB, Berlin, E: [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] In this article, I will give you a brief overview of the current economic situation in Germany and the reasons for this development. Following this, I will explain existing and planned tax incentives and subsidies and critically assess them. At the end of the article I will make four proposals for a more far-reaching reform of German tax law in order to make Germany attractive again as… Read More Underused Housing Tax (UHT) Canada – An Update February 16, 2024 Author: Nicholas Raycroft, CPA Senior Manager, Tax Hendry Warren LLP | Chartered Professional Accountants E: [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] On June 9, 2022, the Canadian Government enacted the “UHT Act”. This tax is intended to discourage ownership of vacant or underused Canadian real estate. We had previously provided an overview of the new UHT in our publication on February 23, 2023 https://integra-international.net/underused-housing-tax-uht-canada/. Since February 23, 2023, the Canadian Government has released additional guidance and amended UHT Act legislation. We thought it would be helpful to provide… Read More

Underused Housing Tax (UHT) Canada – An Update February 16, 2024 Author: Nicholas Raycroft, CPA Senior Manager, Tax Hendry Warren LLP | Chartered Professional Accountants E: [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] On June 9, 2022, the Canadian Government enacted the “UHT Act”. This tax is intended to discourage ownership of vacant or underused Canadian real estate. We had previously provided an overview of the new UHT in our publication on February 23, 2023 https://integra-international.net/underused-housing-tax-uht-canada/. Since February 23, 2023, the Canadian Government has released additional guidance and amended UHT Act legislation. We thought it would be helpful to provide… Read More The US IC-DISC is here to stay: Are you still missing the boat for your exporting clients? February 16, 2024 Author: Paul Ferreira, CPA President of Export Tax Management E: [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] The IC-DISC is the most effective tax planning strategy for your clients who deliver their products for use outside of the United States. In 2017, the U.S. Congress enacted the Tax Cuts and Jobs Act of 2017. This landmark legislation provides permanence for the IC-DISC in 2018 and beyond. Many privately held companies that have products delivered to customers outside of the United States, including Canada and Mexico, are significantly reducing their… Read More

The US IC-DISC is here to stay: Are you still missing the boat for your exporting clients? February 16, 2024 Author: Paul Ferreira, CPA President of Export Tax Management E: [email protected] Edited by: Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ Integra Tax World Newsletter Editor E: [email protected] The IC-DISC is the most effective tax planning strategy for your clients who deliver their products for use outside of the United States. In 2017, the U.S. Congress enacted the Tax Cuts and Jobs Act of 2017. This landmark legislation provides permanence for the IC-DISC in 2018 and beyond. Many privately held companies that have products delivered to customers outside of the United States, including Canada and Mexico, are significantly reducing their… Read More Coming to the Netherlands – favorable tax regime for expats November 22, 2023 Author: Mr. M.A. (Maxim) Boschman LL.M Senior Manager Tax, specialized in (international) payroll taxes at Londen & Van Holland The Dutch economy is mainly driven by human recourses (HR), knowledge and innovation. In order to attract foreign employees who bring specific knowledge to the table, the Dutch tax rules provide a favorable tax regime. This regime is called ‘the 30%-ruling’ and is applicable if certain conditions are met. Dutch wage tax system and the 30%-ruling In principle, everything (in money or in kind) reimbursed, given or provided to employees in that capacity is considered wage, subject to Dutch wage tax… Read More

Coming to the Netherlands – favorable tax regime for expats November 22, 2023 Author: Mr. M.A. (Maxim) Boschman LL.M Senior Manager Tax, specialized in (international) payroll taxes at Londen & Van Holland The Dutch economy is mainly driven by human recourses (HR), knowledge and innovation. In order to attract foreign employees who bring specific knowledge to the table, the Dutch tax rules provide a favorable tax regime. This regime is called ‘the 30%-ruling’ and is applicable if certain conditions are met. Dutch wage tax system and the 30%-ruling In principle, everything (in money or in kind) reimbursed, given or provided to employees in that capacity is considered wage, subject to Dutch wage tax… Read More Top fiscal measures proposed by Romanian Government to be implemented for 2024 and their impact November 22, 2023 Author: Nadia Oanea, CA, Tax Advisor NOA Tax & Training SRL The 2023 summer in Romania was a hot one, with a lot of public discussions on the need to change the tax law, to manage the increased budgetary deficit. After many proposals being discussed in mass media, on September 19, 2023, the Romanian Government published a draft law on some fiscal and budgetary measures to ensure Romania's long-term financial sustainability. On September 26, the Government assumed responsibility in Parliament for this bill. On 27 October 2023, the Law no 296 / 2023 was published in the Official Gazette and… Read More

Top fiscal measures proposed by Romanian Government to be implemented for 2024 and their impact November 22, 2023 Author: Nadia Oanea, CA, Tax Advisor NOA Tax & Training SRL The 2023 summer in Romania was a hot one, with a lot of public discussions on the need to change the tax law, to manage the increased budgetary deficit. After many proposals being discussed in mass media, on September 19, 2023, the Romanian Government published a draft law on some fiscal and budgetary measures to ensure Romania's long-term financial sustainability. On September 26, the Government assumed responsibility in Parliament for this bill. On 27 October 2023, the Law no 296 / 2023 was published in the Official Gazette and… Read More Latvia – Draft Amendments to the Corporate Income Tax Law November 22, 2023 Author: Ina Spridzane, Tax Manager, “Orients Audit & Finance” SIA The Ministry of Finance has prepared a draft for amendments of the Law on corporate income tax for Latvia (CIT) which have been intended for credit institutions and consumer lending service providers. Most countries use so - called standard CIT system where the tax is paid on a company's taxable income, which includes revenue which is reduced for qualifying expenses, for instance, cost of goods sold, general and administrative expenses, selling and marketing, research and development, depreciation, and other operating costs. Thus, the taxpayers pay CIT in the period when… Read More

Latvia – Draft Amendments to the Corporate Income Tax Law November 22, 2023 Author: Ina Spridzane, Tax Manager, “Orients Audit & Finance” SIA The Ministry of Finance has prepared a draft for amendments of the Law on corporate income tax for Latvia (CIT) which have been intended for credit institutions and consumer lending service providers. Most countries use so - called standard CIT system where the tax is paid on a company's taxable income, which includes revenue which is reduced for qualifying expenses, for instance, cost of goods sold, general and administrative expenses, selling and marketing, research and development, depreciation, and other operating costs. Thus, the taxpayers pay CIT in the period when… Read More VAT at 50 in the UK. Will it ever grow up? November 22, 2023 Author: Gavin Barker VAT Director, Bright Grahame Murray The VAT system in its various names (dependant on where you are in the world) has been adopted by 175 countries and yet it has still not been adopted by the US. As many people will be aware, on 1st April 2023, UK VAT turned 50. Now we are part way through the designated VAT party year, I thought I would reflect on some of the history and facts about VAT in general and some of the quirky cases within the UK. First-off a quick history lesson: The creation of VAT is… Read More

VAT at 50 in the UK. Will it ever grow up? November 22, 2023 Author: Gavin Barker VAT Director, Bright Grahame Murray The VAT system in its various names (dependant on where you are in the world) has been adopted by 175 countries and yet it has still not been adopted by the US. As many people will be aware, on 1st April 2023, UK VAT turned 50. Now we are part way through the designated VAT party year, I thought I would reflect on some of the history and facts about VAT in general and some of the quirky cases within the UK. First-off a quick history lesson: The creation of VAT is… Read More New legal framework for transfer pricing in Brazil August 31, 2023 The Brazilian Government has introduced a fresh legal framework for transfer pricing rules through Law No. 14,596/2023, effective from June 15, 2023. This move aligns Brazil's transfer pricing (TP) rules with the Organization for Economic Cooperation and Development (OECD) standards. Previously, Brazil's TP rules diverged from OECD standards, often using fixed margins for TP calculations. This deviation posed challenges for multinational companies with Brazilian subsidiaries. The updated rules apply to transactions with: (i) related parties; (ii) entities in countries that either do not tax income or tax it at a rate below 17%; and (iii) entities benefiting from a privileged… Read More

New legal framework for transfer pricing in Brazil August 31, 2023 The Brazilian Government has introduced a fresh legal framework for transfer pricing rules through Law No. 14,596/2023, effective from June 15, 2023. This move aligns Brazil's transfer pricing (TP) rules with the Organization for Economic Cooperation and Development (OECD) standards. Previously, Brazil's TP rules diverged from OECD standards, often using fixed margins for TP calculations. This deviation posed challenges for multinational companies with Brazilian subsidiaries. The updated rules apply to transactions with: (i) related parties; (ii) entities in countries that either do not tax income or tax it at a rate below 17%; and (iii) entities benefiting from a privileged… Read More VAT Exemption to Imported Goods – Greece August 31, 2023 Based on recent decisions of the Independent Authority of Public Revenues in Greece, the application of a VAT exemption to imported goods under certain procedures detailed below shall no longer be granted if the declared customs value is disputed and subsequently increased by the customs authorities. Certain categories of goods are no longer eligible for VAT exemption on import based on the procedures mentioned above. The relevant measures shall be effective as of 24.07.2023. The procedures and types of goods to which the above decisions apply are the following: Procedures where the new measures apply to cases where a… Read More

VAT Exemption to Imported Goods – Greece August 31, 2023 Based on recent decisions of the Independent Authority of Public Revenues in Greece, the application of a VAT exemption to imported goods under certain procedures detailed below shall no longer be granted if the declared customs value is disputed and subsequently increased by the customs authorities. Certain categories of goods are no longer eligible for VAT exemption on import based on the procedures mentioned above. The relevant measures shall be effective as of 24.07.2023. The procedures and types of goods to which the above decisions apply are the following: Procedures where the new measures apply to cases where a… Read More A Vat full of VAT August 28, 2023 Author Grant Gilmour B.Sc. HONS , MBA, CPA BC Canada , CA, CPA Arizona USA Recently I attended training on VAT in the UAE. That experience made me think about how different VAT programs are similar and different around the world. VAT is new in the UAE. It was implemented in 2018. Like other VAT programs around the world many questions have already come up and the UAE taxation authorities are rapidly bringing forward guidance and clarification. Looking at Value Added Tax conceptually it is similar around the world. It is usually levied by each participant at each step of the process. I… Read More

A Vat full of VAT August 28, 2023 Author Grant Gilmour B.Sc. HONS , MBA, CPA BC Canada , CA, CPA Arizona USA Recently I attended training on VAT in the UAE. That experience made me think about how different VAT programs are similar and different around the world. VAT is new in the UAE. It was implemented in 2018. Like other VAT programs around the world many questions have already come up and the UAE taxation authorities are rapidly bringing forward guidance and clarification. Looking at Value Added Tax conceptually it is similar around the world. It is usually levied by each participant at each step of the process. I… Read More Researching Tax for Integra Tax World August 28, 2023 Author Grant Gilmour B.Sc. HONS , MBA, CPA BC Canada , CA, CPA Arizona USA When I became editor of this newsletter, I knew many members of Integra and in particular many who are primarily tax advisors. What I am growing to know is the large “World” of tax and tax advisors that make up the Integra community. I started to put together a list or tool to help me keep track of what firms are doing and in particular what they have on their websites regarding tax. Think of it as “speed dial” for tax advice in Integra. This is still a… Read More

Researching Tax for Integra Tax World August 28, 2023 Author Grant Gilmour B.Sc. HONS , MBA, CPA BC Canada , CA, CPA Arizona USA When I became editor of this newsletter, I knew many members of Integra and in particular many who are primarily tax advisors. What I am growing to know is the large “World” of tax and tax advisors that make up the Integra community. I started to put together a list or tool to help me keep track of what firms are doing and in particular what they have on their websites regarding tax. Think of it as “speed dial” for tax advice in Integra. This is still a… Read More U.S. Company with Solar Project in Japan Facilitating the Investment and Minimizing Tax May 31, 2023 Authors Chris Klug, JD, LLM Founder, Klug Counsel PLLC Tetsunori (Ted) Chiba, LLM, MST International Tax Partner, Actus Tax Corporation Edited By Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Klug Counsel had the wonderful opportunity to collaborate with Actus Tax Corporation to provide cross-border tax representation to our now mutual client. The Company develops solar and wind projects in Japan. Both owners of the Company are U.S. citizens with one of the owners also being a Japanese tax resident at the time of initial representation. The Company’s business was entering a new phase with a clean energy U.S.… Read More

U.S. Company with Solar Project in Japan Facilitating the Investment and Minimizing Tax May 31, 2023 Authors Chris Klug, JD, LLM Founder, Klug Counsel PLLC Tetsunori (Ted) Chiba, LLM, MST International Tax Partner, Actus Tax Corporation Edited By Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Klug Counsel had the wonderful opportunity to collaborate with Actus Tax Corporation to provide cross-border tax representation to our now mutual client. The Company develops solar and wind projects in Japan. Both owners of the Company are U.S. citizens with one of the owners also being a Japanese tax resident at the time of initial representation. The Company’s business was entering a new phase with a clean energy U.S.… Read More Sparkling wine tax / solidarity surcharge (or the immortality of taxes) May 23, 2023 Author Wagemann + Partner PartG mbB, Berlin, Patrick Löchel, Steuerberater Edited By Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) In Germany, there is a widespread belief among the population that, despite all political assurances to the contrary, a tax once introduced will never be repealed. A prominent example of this is the so-called "sparkling wine tax". This has been levied on carbonated wines with an alcohol content for over 120 years. It covers but is not limited to champagne, crémant and sparkling wine in particular. The tax was introduced 1902 by the German Reichstag (the parliament at… Read More

Sparkling wine tax / solidarity surcharge (or the immortality of taxes) May 23, 2023 Author Wagemann + Partner PartG mbB, Berlin, Patrick Löchel, Steuerberater Edited By Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) In Germany, there is a widespread belief among the population that, despite all political assurances to the contrary, a tax once introduced will never be repealed. A prominent example of this is the so-called "sparkling wine tax". This has been levied on carbonated wines with an alcohol content for over 120 years. It covers but is not limited to champagne, crémant and sparkling wine in particular. The tax was introduced 1902 by the German Reichstag (the parliament at… Read More Implementation of a Global Minimum Tax Rate May 23, 2023 An overview of OECD Pillar Two Model Rules Author Bright Grahame Murray, Cheryl Thomas, Partner (ACA CTA ) Edited By Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) The Organization for Economic Co-operation and Development [OECD] Base Erosion and Profit Shifting [BEPS] programme introduced 15 actions to ensure profits are taxed where economic activities generating the profits are performed and where value is created. Action 1 was to address the tax challenges arising from the Digitalisation of the Economy. In the middle of 2021, the international community agreed a Two-Pillar Solution to address these issues. Currently, multinational enterprises… Read More

Implementation of a Global Minimum Tax Rate May 23, 2023 An overview of OECD Pillar Two Model Rules Author Bright Grahame Murray, Cheryl Thomas, Partner (ACA CTA ) Edited By Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) The Organization for Economic Co-operation and Development [OECD] Base Erosion and Profit Shifting [BEPS] programme introduced 15 actions to ensure profits are taxed where economic activities generating the profits are performed and where value is created. Action 1 was to address the tax challenges arising from the Digitalisation of the Economy. In the middle of 2021, the international community agreed a Two-Pillar Solution to address these issues. Currently, multinational enterprises… Read More Underused Housing Tax (UHT) Canada February 23, 2023 By Nicholas Raycroft, Hendry Warren Edited by Grant Gilmour On June 9, 2022, the Canadian government enacted the "UHT Act”. This tax is intended to discourage the ownership of vacant or underused Canadian real estate. Although it primarily targets ownership of Canadian real estate by non-resident non-Canadians, this tax may be applicable to certain Canadian-Controlled Private Corporations (CCPCs), trusts and partnerships. The UHT will be administered by the Canada Revenue Agency. Overview The UHT imposes a 1% tax on the taxable value of residential property to owners on December 31of a calendar year, other than "excluded owners", of residential… Read More

Underused Housing Tax (UHT) Canada February 23, 2023 By Nicholas Raycroft, Hendry Warren Edited by Grant Gilmour On June 9, 2022, the Canadian government enacted the "UHT Act”. This tax is intended to discourage the ownership of vacant or underused Canadian real estate. Although it primarily targets ownership of Canadian real estate by non-resident non-Canadians, this tax may be applicable to certain Canadian-Controlled Private Corporations (CCPCs), trusts and partnerships. The UHT will be administered by the Canada Revenue Agency. Overview The UHT imposes a 1% tax on the taxable value of residential property to owners on December 31of a calendar year, other than "excluded owners", of residential… Read More Private Foundations and Trusts | The same but different around the world February 23, 2023 By Wagemann + Partner PartG mbB, Berlin, Dr. Filip Schade, Steuerberater, Master of Laws Edited By Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Question: Is there an internationally coordinated set of rules regarding the legal and tax treatment of private foundations and trusts? Answer: The OECD has hardly any recommendations available and there are no harmonization efforts observable. Private foundations and trusts remain a purely national and sometimes regional matter. When preparing this article, I asked myself whether there is an international set of rules in which many countries have agreed on certain principles for the… Read More

Private Foundations and Trusts | The same but different around the world February 23, 2023 By Wagemann + Partner PartG mbB, Berlin, Dr. Filip Schade, Steuerberater, Master of Laws Edited By Integra International Grant Gilmour, CPA (Canada, BC) CPA (USA, Arizona) Question: Is there an internationally coordinated set of rules regarding the legal and tax treatment of private foundations and trusts? Answer: The OECD has hardly any recommendations available and there are no harmonization efforts observable. Private foundations and trusts remain a purely national and sometimes regional matter. When preparing this article, I asked myself whether there is an international set of rules in which many countries have agreed on certain principles for the… Read More